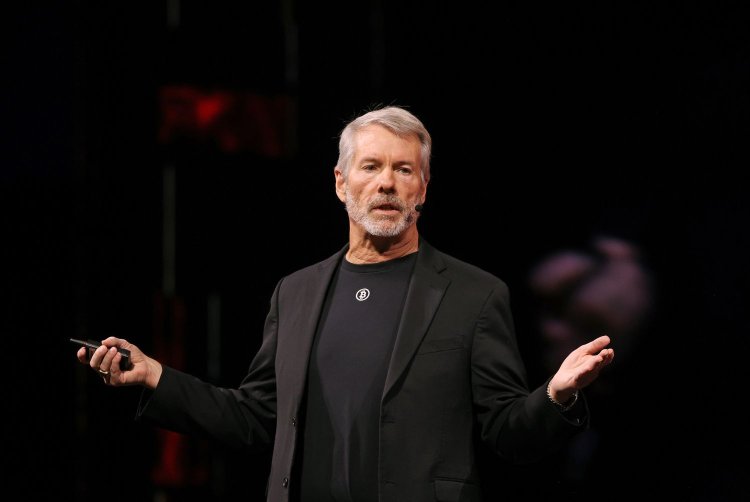

Michael Saylor doubles down as Strategy continues aggressive Bitcoin buying amid market volatility

In early 2026, Michael Saylor, Executive Chairman of Strategy (formerly MicroStrategy), confirmed that the company has continued its aggressive Bitcoin accumulation strategy, even as the cryptocurrency market remains volatile and investor sentiment cautious.

According to disclosures as of January 10, 2026, Strategy made a significant Bitcoin purchase in the final week of December 2025, acquiring 1,229 BTC for approximately $108.8 million. The purchase was executed at an average price of $88,568 per Bitcoin and was financed through the sale of company shares, a funding approach the firm has repeatedly used to expand its digital asset treasury.

Treasury holdings near 674,000 BTC

Following this purchase and additional smaller acquisitions in early January, Strategy’s total Bitcoin holdings have reached 673,783 BTC. The company’s cumulative investment in Bitcoin now stands at roughly $50.6 billion, translating to an average cost basis of $75,026 per Bitcoin.

This makes Strategy by far the largest corporate holder of Bitcoin globally, reinforcing its position as a high-conviction institutional proxy for the cryptocurrency.

Buying through a challenging market cycle

The latest acquisition capped off a difficult year for cryptocurrencies. Throughout late 2025 and early 2026, Bitcoin has traded in a choppy range between $80,000 and $95,000, struggling to regain momentum after its October 2025 peak, when prices briefly surged above $123,000–$126,000.

Despite the pullback, Strategy has maintained its long-term thesis that Bitcoin represents superior digital capital and a hedge against monetary debasement, a view consistently championed by Saylor.

Stock pressure versus balance-sheet gains

While the company’s Bitcoin bet has strengthened its balance sheet on paper, Strategy’s stock (MSTR) faced significant pressure in 2025, falling by nearly 47 percent. The decline reflected investor concerns over share dilution, heightened exposure to crypto volatility, and broader risk-off sentiment across technology and digital asset markets.

However, based on early January 2026 market prices, Strategy reported an unrealized (paper) profit exceeding $12 billion on its Bitcoin holdings, highlighting the scale of upside the company continues to target through its accumulation strategy.

High conviction, high risk

Strategy’s approach remains one of the boldest corporate treasury strategies in modern financial markets. While supporters view the company as a long-term Bitcoin bellwether, critics continue to flag the risks associated with leverage, dilution, and prolonged crypto downturns.

For now, Saylor and Strategy appear unmoved by short-term volatility, signaling that Bitcoin accumulation, not market timing, remains at the core of the company’s financial strategy.